In this post title “Kuda vs Opay which is better?” We will be carrying out a head to head comparison of these to online banking platforms. You know in these recent days, mobile banking and mobile money platforms have revolutionized the way we manage our finances, providing convenient and accessible solutions. In Nigeria, two prominent players in this space are Kuda and Opay. Both platforms offer a range of financial services, but which one should you choose? In this article, we will compare Kuda vs Opay, examining their features, benefits, drawbacks, and overall performance. So, let’s dive in and explore the strengths and weaknesses of these two platforms to determine which is the better option.

Before going into the head to head comparison of these two platforms Kuda and Opay to know which is better, we will first explain some certain informations you need to know about them.

What is Kuda? Who is its owner?

Kuda is a Nigerian neobank that was founded in 2019 by Babs Ogundeyi and Musty Mustapha. It stands out as a mobile-only bank, offering a wide array of financial services, including savings accounts, checking accounts, loans, and investments. With full licensing and regulation from the Central Bank of Nigeria, Kuda ensures the security and reliability of its services.

What is Opay? The founder of Opay

Opay is a Nigerian mobile money platform that was founded in 2018 by Opera. It provides a range of financial services, including payments, transfers, airtime and data top-up, bill payments, and more. With full licensing and regulation from the Central Bank of Nigeria, Opay offers secure and convenient financial solutions to its users.

Account Features and Services: Kuda vs Opay which is better?

Now let’s, start the comparison of Kuda and Opay which is better? With its features and services before going further to other factors.

Kuda’s Account Features and Services

Kuda offers a comprehensive set of account features and services, including:

- Savings accounts with high-interest rates.

- Current (checking) accounts for day-to-day transactions.

- Access to loans for personal and business needs.

- Investments options to grow wealth.

- Debit cards for convenient payments.

- Bill payments and fund transfers.

- Spending insights and budgeting tools.

Opay’s Account Features and Services

Opay provides a range of account features and services, including:

- Mobile wallet for payments and transfers.

- Airtime and data top-up services.

- Bill payments for utilities and other services.

- International money transfers.

- Virtual cards for online transactions.

- Access to loans and micro-insurance.

- Cashback rewards on transactions.

In this stage of comparison, I will choose Kuda for it’s investment options which is great for growing wealth and it’s budgeting tools. And I will choose Opay over Kuda for it’s fast response when buying airtime and its Cashback which is really amazing, what do you think about this? The choice is yours, let’s move on to second stage.

Fees and Charges: Kuda vs Opay which is better?

Now, the next stage of this out comparison of Kuda vs Opay which is better? We will check out the platform that saves more of your money during transactions. Let’s check this out and draw conclusion.

Kuda’s Fees and Charges

Kuda prides itself on offering transparent and low fees for its services. Some of the common fees charged by Kuda include:

- No monthly account maintenance fees.

- Free transfers between Kuda accounts.

- Nominal fees for transfers to other banks.

- ATM withdrawal fees (dependent on the ATM operator).

Opay’s Fees and Charges

Opay also aims to provide affordable financial services, and its fees are generally competitive. Here are some of the fees associated with Opay:

- No monthly account maintenance fees.

- Free transfers to other Opay users.

- Nominal fees for transfers to bank accounts.

- ATM withdrawal fees (dependent on the ATM operator).

In this stage of comparison, I will say the Kuda vs Opay comparison is a draw because both platform’s deductions after transactions are the same and none in most cases.

User Experience and Accessibility

Now, moving over to the user experience of these respective platforms, let’s analyze which is great and better in offering good users experience to it’s visitors and users both in web and mobile App.

Kuda’s User Experience and Accessibility

Kuda offers a user-friendly mobile app with an intuitive interface. The app allows users to easily navigate and access various banking features, including managing accounts, making transfers, and monitoring transactions. Kuda’s services are primarily accessed through its mobile app, which is available for both Android and iOS devices.

Opay’s User Experience and Accessibility

Opay also provides a user-friendly mobile app for easy access to its services. The app allows users to make payments, transfers, and other transactions conveniently. Opay’s mobile app is available for both Android and iOS devices, ensuring broad accessibility for users.

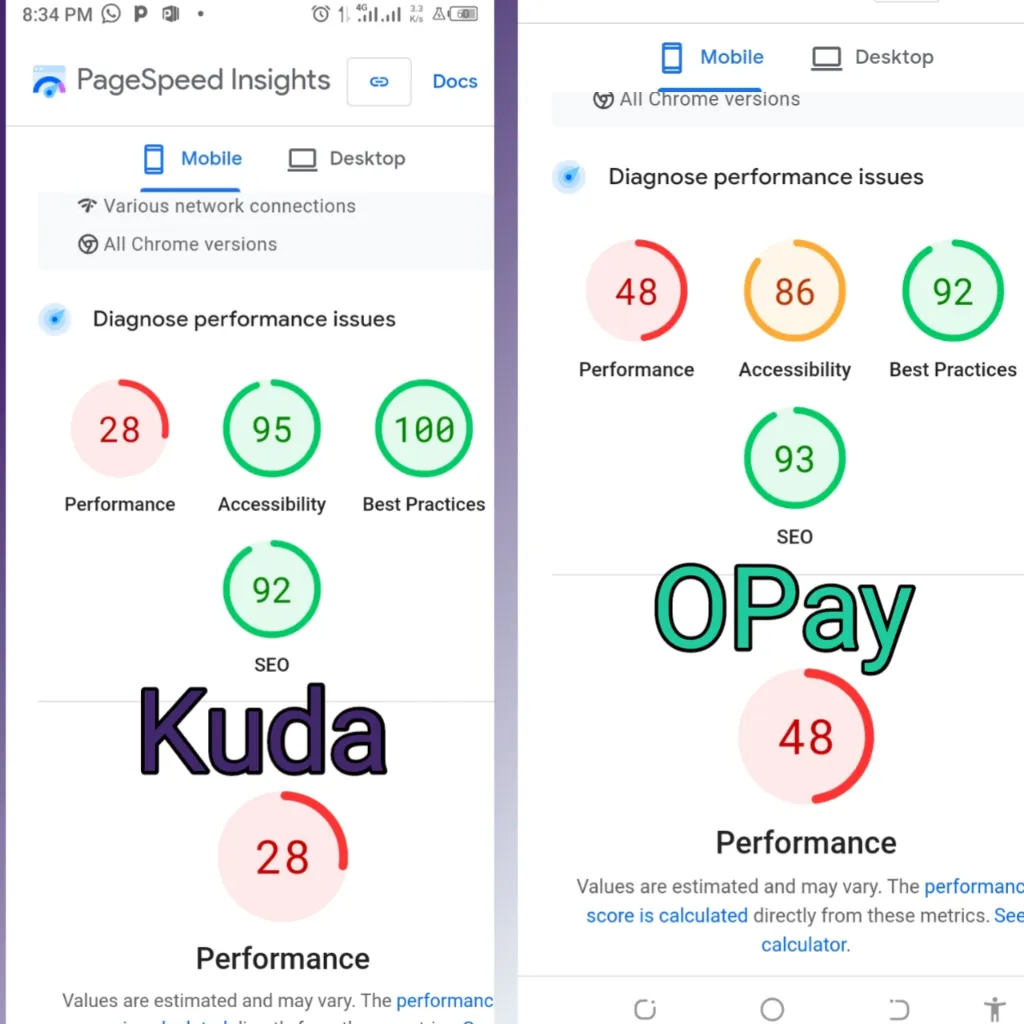

From the above analysis you can say they both have the same user experience, but out of two good there must always be a better. In our analysis, we took a tour to Playstore and the reviews these two Apps got was really great then we move over to their websites. One of the key factors in web user experience is website speed optimization according to google insider mostly in Mobile, so we analyzed the mobile speed of these websites using page speed insight. You can see the results in the image below, from the image they are both bad but Opay has a better user experience for those accessing through mobile phones.

Security and Privacy: Kuda vs Opay which is better?

Another important aspect of banking and finance is Security and Privacy protection, so we will grade Kuda and Opay based on these two factors to know which is better for online banking.

Kuda’s Security and Privacy

Kuda prioritizes the security and privacy of its customers. It implements robust security measures, such as two-factor authentication, encryption, and secure socket layer (SSL) technology to protect user data and transactions. Kuda also maintains strict confidentiality and follows regulatory guidelines to ensure the privacy of customer information.

Opay’s Security and Privacy

Opay also places a strong emphasis on security and privacy. It employs security protocols, including encryption and secure communication channels, to safeguard user data and transactions. Opay adheres to regulatory standards and employs robust security measures to maintain the privacy of customer information.

These two platforms Kuda and Opay make use of all the necessary information and security management measures such as OTP and Two factor Authentication to protect their customer’s funds and privacy. So, you can’t make a choice based on this because they are the same in this aspect.

Customer Support : Kuda vs Opay which is better?

Now, another important aspect to note while comparing Kuda and Opay which is better? Is customer support, because it is very vital Incase of bugs and failed transactions.

Kuda’s Customer Support

Kuda provides customer support through various channels, including in-app chat support, email, and phone. Users can reach out to Kuda’s support team for assistance with account-related queries, technical issues, and general inquiries. Kuda aims to provide timely and effective customer support to ensure a positive user experience.

Opay’s Customer Support

Opay offers customer support through its mobile app and website. Users can access help articles, FAQs, and submit support tickets for assistance. Opay strives to address customer queries and concerns promptly, ensuring that users have access to the necessary support they require.

Availability and Expansion

Another important aspect to compare in this Kuda and Opay which is better? Comparison is it’s availability to users.

Kuda’s Availability and Expansion

Currently, Kuda operates exclusively within Nigeria, serving Nigerian customers. However, it has plans for expansion and may potentially extend its services to other countries in the future. Kuda’s growth and availability outside of Nigeria will depend on its strategic plans and regulatory approvals.

Opay’s Availability and Expansion

Opay also primarily serves Nigerian customers, with a focus on expanding its services across different regions within Nigeria. While Opay has not yet expanded to other countries, it may explore opportunities for international expansion in the future.

In this aspect I will be a bit practical, actually in my environment where I live in Ondo state I do see Opay POS but have never seen a Kuda POS. So, I can draw a conclusion that Opay is more Popular and available to uses than Kuda based on this example.

Pros and Cons: Kuda vs Opay which is better?

We will analyze the Pros and Cons of these platforms below, go through them before making your choice between Kuda and Opay which is better:

Kuda Pros:

- No monthly fees: Kuda does not charge any monthly fees for its accounts.

- Low fees: Kuda charges very low fees for its services, such as transfers and ATM withdrawals.

- Easy to use: Kuda’s mobile app is designed to be user-friendly and easy to navigate.

- High interest rates: Kuda offers competitive interest rates on its savings accounts.

- Rewards program: Kuda has a rewards program that allows users to earn points for using their debit cards, which can be redeemed for discounts and other rewards.

- Security: Kuda uses state-of-the-art security measures to protect users’ money.

Kuda Cons:

- Limited availability: Currently, Kuda is only available in Nigeria.

- Customer support: Some users have reported that Kuda’s customer support is not as responsive or efficient as other banks.

- No ATM network: Kuda does not have its own ATM network, limiting users to only withdraw money from ATMs that are part of the Visa or Mastercard network.

Opay Pros:

- Wide availability: Opay is available in over 100 cities in Nigeria, making it accessible to a large user base.

- Low fees: Opay charges low fees for its services, including transfers and airtime top-up.

- Easy to use: Opay’s mobile app is designed to be user-friendly and intuitive.

- Secure: Opay employs advanced security measures to safeguard users’ funds and transactions.

- Rewards program: Opay offers a rewards program that allows users to earn points for using their Opay wallet, which can be redeemed for discounts and other rewards.

Opay Cons:

- Limited features: Opay may not offer as many features compared to some other mobile money platforms.

- Customer support: Some users have reported that Opay’s customer support can be slow or unresponsive at times.

- No ATM network: Similar to Kuda, Opay does not have its own ATM network, restricting cash withdrawals to ATMs within the Visa or Mastercard network.

It’s important to consider these pros and cons when choosing between Kuda vs Opay, as they highlight the strengths and limitations of each platform.

RECOMMENDED: Check out SCAM ALERTS in this page

Conclusion

In conclusion, both Kuda and Opay offer valuable financial services to Nigerian users. The choice between the two depends on individual preferences and needs. Kuda stands out as a mobile-only neobank with a range of banking features, including savings accounts, loans, and investments. Opay, on the other hand, focuses on mobile payments, transfers, and bill payments. Consider factors such as account features, fees, user experience, security, customer support, and availability when deciding which platform better aligns with your financial requirements. It is recommended to explore each platform further and compare their offerings before making a decision.

I hope you are satisfied with this Kuda vs Opay which is better? Head to head comparison, they are both great platforms, though Opay won in some aspects and features.

Frequently asked questions about Kuda and Opay

As we have finished the comparison of Kuda vs Opay to know which is better, let’s check out other frequently asked questions about these two platforms:

Can I open an account with Kuda or Opay if I am not a Nigerian resident?

No, both Kuda and Opay require you to be a Nigerian citizen or resident to open an account.

How do I deposit funds into my Kuda or Opay account?

You can deposit funds into your Kuda or Opay account through various methods, including bank transfers, card payments, and in some cases, cash deposits at designated agent locations.

Can I use Kuda or Opay for international transactions?

Kuda and Opay primarily focus on providing financial services within Nigeria. While some international transactions may be supported, it is advisable to check with the respective platforms for specific details and limitations.

What are the interest rates offered by Kuda on its savings accounts?

Kuda offers competitive interest rates on its savings accounts, but the specific rates may vary. It is recommended to refer to Kuda’s official website or contact their customer support for the most up-to-date information on interest rates.

Does Opay offer cash withdrawal services?

Yes, Opay allows you to withdraw cash from your Opay account through supported ATMs that are part of the Visa or Mastercard network.

Are there any limits on transactions and transfers with Kuda and Opay?

Kuda and Opay may have certain limits on transactions and transfers, including daily or monthly limits. These limits are in place to ensure security and regulatory compliance. It is advisable to refer to the platforms’ terms and conditions or contact their customer support for detailed information on transaction limits.

What additional services does Kuda offer apart from banking?

In addition to banking services, Kuda offers features such as budgeting tools, savings goals, and investment options. These additional services are designed to help users manage their finances more effectively.

Can I access my Kuda or Opay account on multiple devices?

Yes, you can access your Kuda or Opay account on multiple devices, including smartphones and tablets, by logging in with your credentials on the respective platforms’ mobile apps.

How long does it take to open an account with Kuda or Opay?

The account opening process for both Kuda and Opay is typically quick and convenient. It generally involves providing the necessary personal information, completing verification steps, and can be completed within a few minutes.

Are my funds safe with Kuda and Opay?

Both Kuda and Opay prioritize the security of customer funds and employ robust security measures to protect user data and transactions. They also operate under the regulatory framework provided by the Central Bank of Nigeria. However, it is important to note that all financial transactions carry some level of risk, and it is advisable to follow best practices in securing your account and personal information.